The Netherlands

RockRose Energy entered the Dutch oil and gas exploration & production sector through the 2018 acquisition of Dyas BV which included its interests in the A&B Blocks, the K4b-K5a area, and the Hanze oil field. With Viaro Energy’s 2021 acquisition of Hague and London Oil (HALO) BV portfolio, the company gained assets in the Joint Development Area partnership. RockRose Energy also has interests in several other offshore and onshore assets in the Netherlands, including the Rijn field, F15AB, the Greater Markham Area, the Bergen Concession, and the strategic gas store Alkmaar PGI.

RockRose Energy has non-operated interests in the A&B Blocks, made up of 6 gas fields operated by Petrogas. Five of the fields A12, A18, B13, B10 and A15 are onstream. The …producing fields were brought onstream using a Central Processing Platform (CPP), with compression facilities to address the low pressure of the Pleistocene-age reservoirs. B10 and A15 the latest to be development, came online in 2024. Due to capacity constraints at the CPP, a phased development approach has been pursued in the area. Gas is exported via a spurline to the A/6-F/3 pipeline, which in turn links to the NOGAT pipeline for transportation to Den Helder.

Read more

Equity

Status

Location

Potential

Latest Production Results

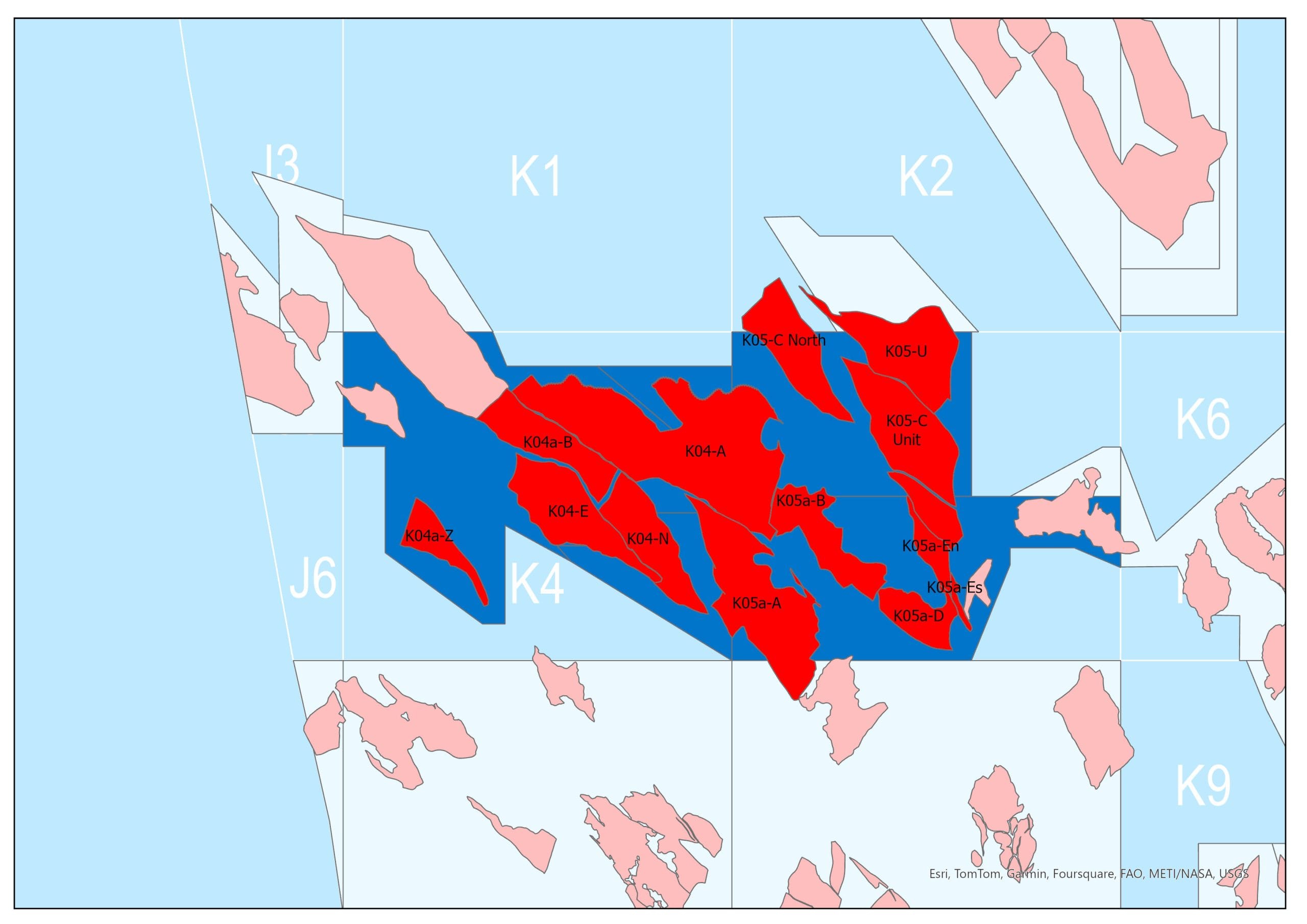

RockRose Energy’s interests in the K4b-K5a Blocks include 9 gas fields operated by Total Energies, 1 of which has ceased production. The area was developed with a CPP over the K/5…-A structure and 5 unmanned wellhead platforms to produce gas from the satellite fields. The assets were developed in phases, with first gas achieved from K/5-A and K/5-D in 1994, while K/5-F was brought onstream in 2008. Apart from K/5-F field, which exports its gas via the NGT pipeline to Uithuizen, gas from the area is exported via the equity-owned WGT pipeline to Den Helder.

Read more

Equity

Status

Location

Potential

Latest Production Results

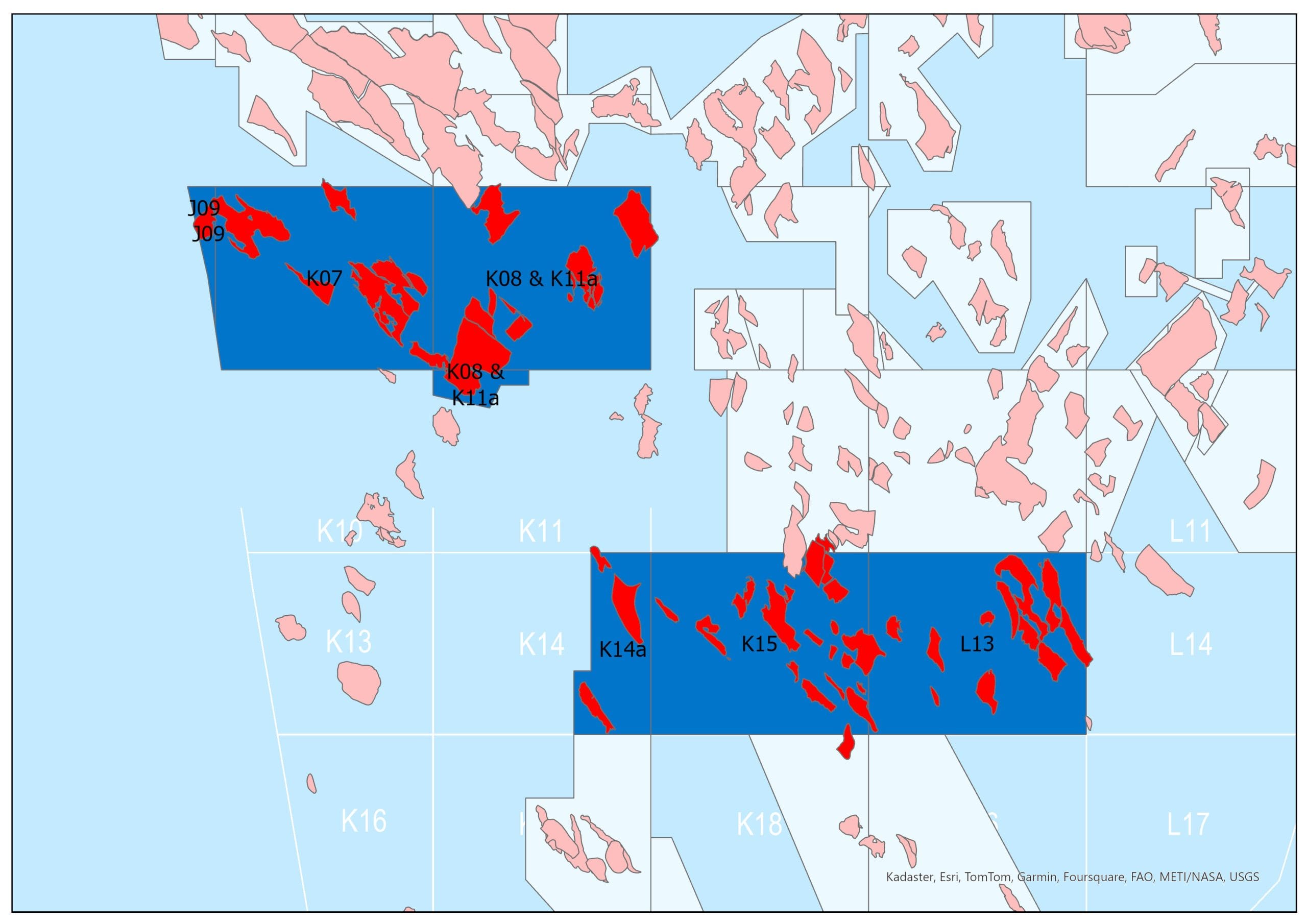

RockRose Energy obtained interests in the JDA through Viaro Energy’s 2021 acquisition of HaLO BV. The JDA covers 6 unitised licences (K07, K08, K11, K14, K15, and L13) and 23 …producing fields. It is operated by NAM, a Shell and ExxonMobil joint venture. The main processing hubs within the JDA are the K7-FA and K8-FA to the north, and the K14-FA, K15-FA and K-15-FB to the south. Gas is produced from both high-caloric (HiCal) and low-caloric (LoCal) gas fields. HiCal gas is delivered into the Wintershall-operated WGT pipeline, while the LoCal gas is delivered via a dedicated JDA-owned pipeline to Den Helder. K15-FA receives most of the HiCal gas, and LoCal gas is delivered to the K15-FB platform. RockRose Energy also has interests in the K18-Golf field, a subsea tie-back to the K15-FA facility within the JDA operated by Wintershall.

Read more

Equity

Status

Location

Potential

Latest Production Results

Discovered in 1996, the Dana-operated F02a Hanze oil field was developed using a steel gravity-based platform containing a storage tank with capacity of 150,000 barrels at its base…. Oil is produced from a heavily fractured Cretaceous chalk reservoir, while a shallower Pliocene gas reservoir was sanctioned for development in 2009 and produces from a single horizontal well. Oil is exported by shuttle tankers, and gas is exported via a spurline to the A/6-F/3 pipeline, which in turn links to the NOGAT pipeline for transportation to Den Helder.

Read more

Equity

Status

Location

Potential

Latest Production Results

RockRose Energy has interests in several other assets in the offshore and onshore Netherlands. These mostly include late-life assets that produced a combined average of 500 …boepd net to RockRose in 2023. The company’s other interests include several transportation and storage facilities.

Read more

F15A&B

Location: Offshore Netherlands

Equity: 8.82%

Overview: Late-life assets in production since 1993, with deferred decommissioning cost and timing upside.

P&Q Blocks

Location: Offshore Netherlands

Equity: ~10% – 30% across various fields

Overview: Assets predominately decommissioned, with remaining production from Q1B.

Markham Area

Location: Offshore Netherlands

Equity: 1.73% – 4.43%

Overview: Hub for third-party tariff business, located on the border of the UKCS and the NLCS. J3C and Grove equity gas transported through Markham.

P15/P18/Rijn

Location: Offshore Netherlands

Equity: 45.69%

Overview: Predominantly oil output from the Rijn field, potential for further development drilling.

WGT

Location: Offshore Netherlands

Equity: 8.88%

Overview: WGT Pipeline system and WGT extension transporting equity gas to Den Helder.

Bergen

Location: Onshore Netherlands

Equity: 12%

Overview: Mature production with upside potential from NAM-operated West Beemster field.

Alkmaar PGI

Location: Onshore Netherlands

Equity: 12%

Overview: Strategic Peak Gas storage facility providing fixed risk-free cash flow through capacity provision contracts.

Other Operations…

UK Northern North Sea

West of Shetland